Busy At Maths

If you were to summarize for your grandmother how an AI crypto trading agent works, how might you do it? Would you pull up some slides from your 601 statistics class and begin an impromptu lecture on Markov chains? Would you call it a robot? Would you need to reference both Cryptonomicon AND Neuromancer? Or maybe you’d just wave your hands around and say it’s basically Harry Potter magic.

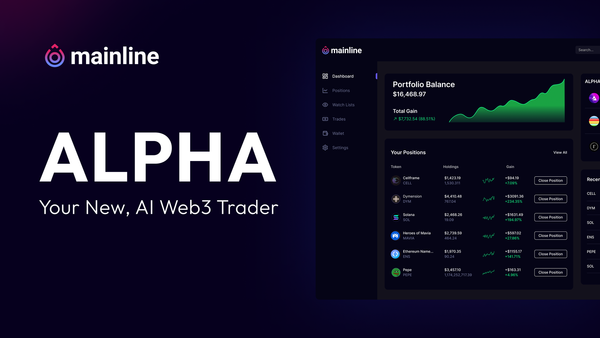

This is the luxury of using Mainline ALPHA. Much like a flying broom, you don’t need to understand it to use it. But, we’re here anyway to explain how it works in case you’d like to peek behind the curtain.

How It’s Made: Profit

The Mainline ALPHA gigabrain ultimately arrives at buy/sell decisions after concocting a cosmic gumbo with the following ingredients:

- A first-of-its-kind Algorithmic Sentiment tool

- Key crypto market data points

- Machine learning

- Pappap’s technical analysis textbook

- Witty banter and obscure cultural references

- Wizard math

Mainline has spent years developing a first-of-its-kind Algorithmic Sentiment tool. This lil’ doohickey is built from network theory, proprietary algorithms and metrics, and more maths than you can shake a stick at. With this, the algo-sentient ALPHA brain constantly trawls X to mathematically find data points such as the social weight of someone’s words, “real eyeballs” counts of engagement, degree of fake engagement, bot activity, and coordination within a post, or even within a poster’s followers.

Better yet, unlike other tools on the market, Mainline does not use the crutch of Natural Language Processing to determine if a tweet is positive, negative, or neutral–because the real world is not that simple.

ALPHA is able to determine the authenticity and virality of conversations at an account level, which turns out to be a great predictor of price action in crypto. That said, it matters who says what, and ALPHA has gotten quite good at getting to the root of that. This type of work is something only years of development will get you. Did we mention we’ve been building ALPHA for years?

Into the pot we also add considerations like smart contract audit information, stablecoin flows on CEXs and DEXs, stable-volatile pair swaps, and point-of-interest wallets. And, of course, no market analytical model would be complete without the ever-drifting North Star that is traditional technical analysis (Bollinger bands, WMA, EMA, MACD, etc).

Finally, to twist the final screw on this tortured cooking metaphor, Mainline heaps on a few select machine learning methods for determining trade parameters. The most important of these is the Kelly Criterion, which probabilistically optimizes a series of investments in an uncertain environment based on a geometric mean. Practically speaking, by using historical data for a target token (or similar tokens, if it’s a new token), and through constant backtesting, ALPHA can determine the highest probability of a winning trade across a portfolio of targets. In these calculations, ALPHA considers trade size, take-profit target, stop-loss, profit horizon, and other factors.

ALPHA is a machine–it can do a lot at once.

Sum Up

If you’re thinking, “this sounds like a lot of data,” you’re right. Our feeble human minds reel at figuring this all out on our own. Indeed, it took a team of buildors several years to create ALPHA...

... and it's just been getting smarter and smarter.